AWSJ, 7 Sep 2012

By TOM ORLIK

Conventional wisdom says that China's poor save too much—improving the social safety net would encourage them to hit the shops and rev the consumption engine. The facts disagree.

A 2011 survey from China's South Western University of Finance and Economics found that 55% of China's households had little or no savings for the year. That busts the myth of industrious farmers and migrant workers saving to pay for education, health care and pensions.

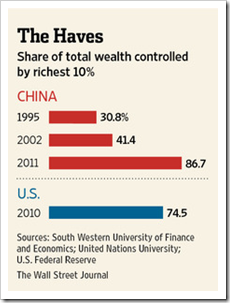

International and historical comparisons suggest China's wealth gap should be ringing alarm bells. Surveys in 1995 and 2002 found that back then China's top 10% controlled just 30% and 41% of wealth, respectively. In the United States, Federal Reserve numbers show the top 10% are eating 74% of the pie.

Concentrating wealth in the hands of China's few has implications for both financial and social stability.

China's rich are already buying passports and homes abroad. With such a high share of assets in their hands, if they all decide to leave at once, that would leave a big hole in the banking system. China's poor have acquiesced in an iniquitous system because their income is also rising; if that stops, they might not be so tolerant of entrenched privilege.

The main takeaway though is on the prescription for addressing China's consumption-light growth model. The government's efforts so far have focused on extending public health, education and pension services to reduce the need for household precautionary saving and to free up income to spend at the shops.

That won't do the job. The reason the mass of China's households aren't spending isn't because they save too much, it's because their incomes are too low. The reason the rich are saving isn't because they want to, it's because they have too much money to spend all of it. The best way to boost consumption in China is not through extending public services but through a more equitable distribution of income.

0 comments:

Post a Comment